How much gold is allowed from Qatar to India (2025 guide)

Passengers may carry up to 1 kilogram of gold to India in baggage on payment of customs duty. A duty-free jewellery allowance applies only to travellers who lived abroad >1 year: men up to 20g (₹50,000), women up to 40g (₹100,000). Origin (Qatar or elsewhere) doesn’t change India’s rules; declaration at arrival is required.

Do this next

- Decide if you’re carrying jewellery only (possibly partly duty-free) or bars/coins/jewellery above the free limit (duty payable).

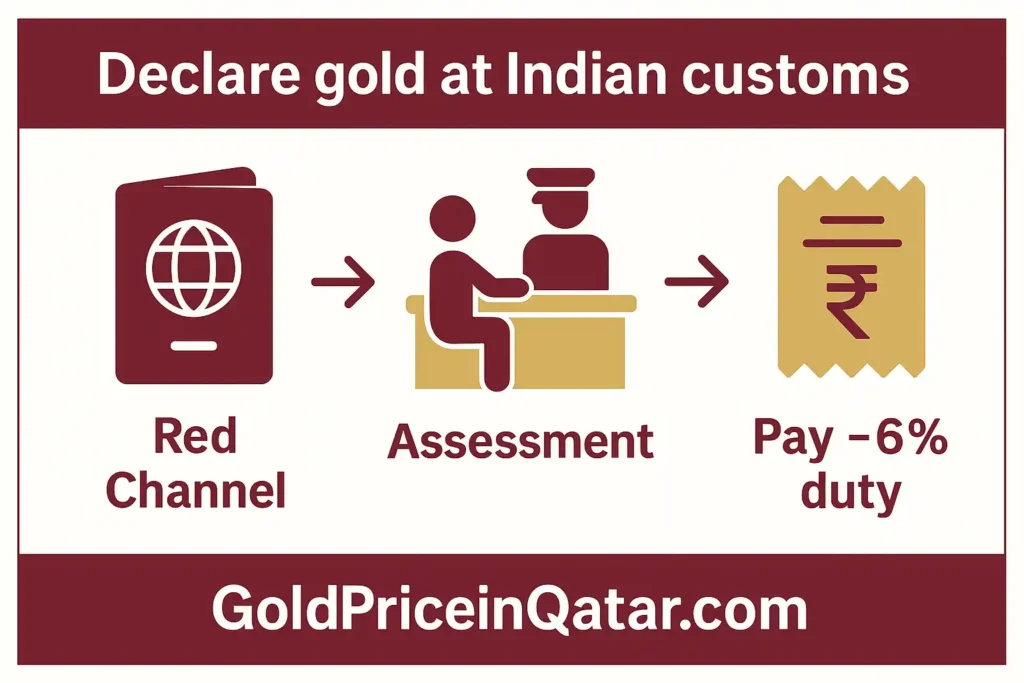

- Fill the customs declaration and choose the Red Channel at arrival.

- Pay duty at the counter (keep receipt); collect stamped declaration for your records.

What the rules actually say (2025)

Core limits in plain English

- Duty-paid cap: Up to 1 kg of gold (including jewellery) per passenger as baggage on payment of duty.

- Duty-free jewellery (personal use):

- Men: up to 20 grams capped at ₹50,000.

- Women: up to 40 grams capped at ₹100,000.

- Available only if you resided outside India for more than one year before arrival.

- Country of departure: India’s customs rules apply uniformly—coming from Qatar does not change the allowance.

- Bars/coins: No duty-free allowance; declare and pay duty.

Current duty picture (2025)

- Gold import duty (customs): ~6% on value for standard passenger imports.

- Some airports display additional line items (e.g., handling/assessment). Your official receipt will show the calculation.

Why numbers differ online: Many posts cite older rates (10–15%). India reduced the import duty to ~6% in 2024/2025. Always check airport signage or ask the officer at arrival if you need the exact breakdown.

Who can use the jewellery duty-free allowance?

Residence condition (the key filter)

- You must have stayed abroad >1 year immediately before arrival.

- Short visits home (up to about a month in total) typically don’t break the one-year count.

What counts as “personal use”

- Everyday jewellery you personally wear or carry in your baggage.

- Not samples or merchandise; not multiple identical pieces suggesting trade.

Children & seniors

- If they also meet the >1 year abroad rule, the same limits apply.

Step-by-step: declaring gold at an Indian airport

Before you fly

- Keep purchase invoices (Qatar store bill is fine).

- Weigh your jewellery/bars, list grams and karat (e.g., 22K).

- Pre-estimate duty to avoid surprises.

Source: Indian customs

On the plane / on arrival

- Fill the customs declaration (or e-form where available).

- Choose Red Channel at arrival (declaration required).

At the counter

- Present items for inspection and weighing.

- Officer assesses value (international price/airport tariff).

- Pay duty; receive the stamped receipt + declaration.

- Keep these for future travel or if questioned by any authority.

Practical examples

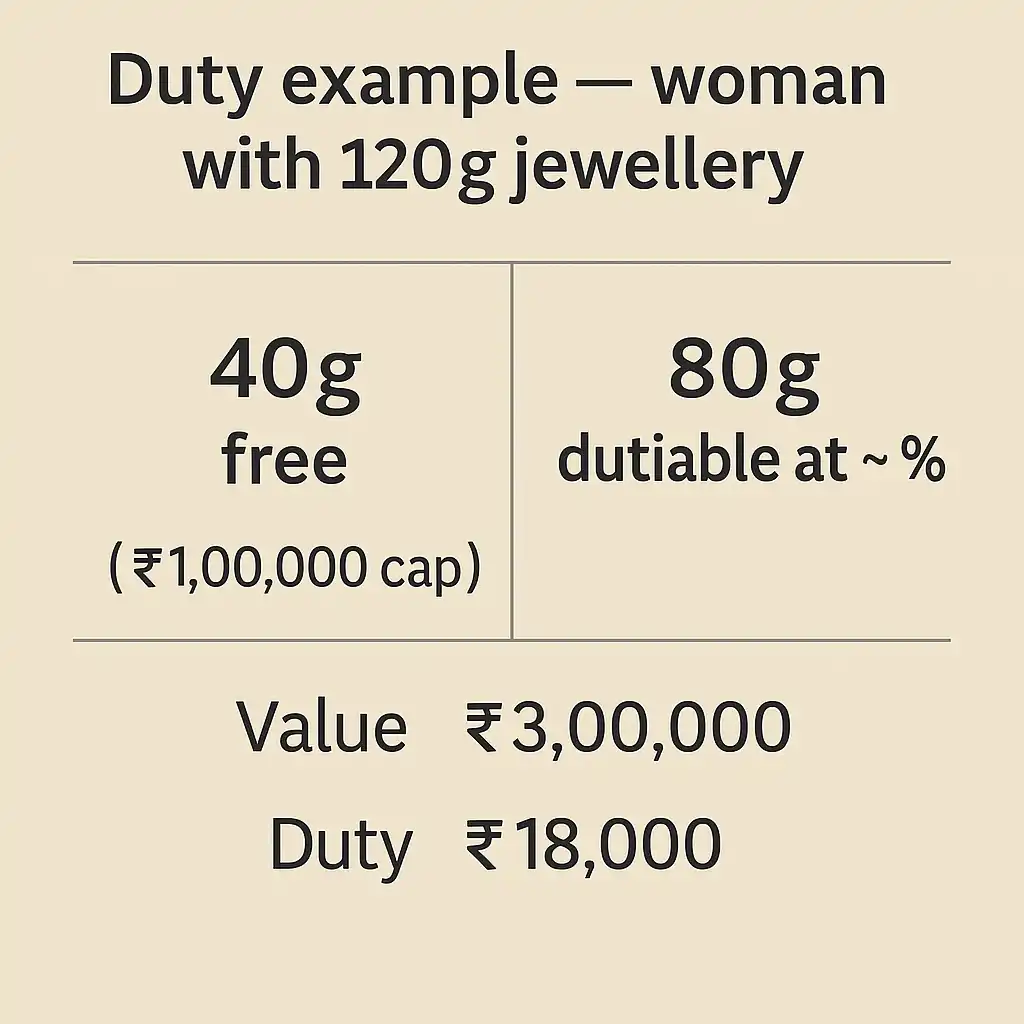

Example 1 — Woman with mixed pieces (Qatar → Mumbai)

- Items: 22K jewellery 120g, invoice value ₹6,00,000.

- Duty-free portion: 40g up to ₹1,00,000 (if >1 year abroad).

- Duty-paid portion: 80g (value above the free cap) → billed at ~6%.

Example 2 — Man with a 100g bar

- No duty-free on bars. Entire 100g is dutiable at ~6%.

Example 3 — Couple together

- Allowances are individual. A couple may combine only in the sense that each uses their own limit.

Edge cases & things that cause trouble

Over 1 kg in baggage

- Not allowed for passenger baggage imports. Split beyond 1 kg across different eligible travellers or ship via authorized channels (not recommended without expert help).

Break-journeys and stopovers

- Irrelevant to India’s rule—your final arrival into India is what matters.

Red vs Green Channel

- Always declare. Attempting to walk Green with dutiable gold risks seizure, penalties, or prosecution.

Coins, medallions, bullion with designs

- Treated as gold; not numismatic exceptions unless certified as such (rare).

Qatar-specific notes (for travellers departing Doha)

Buying in Qatar

- Keep the Qatar shop invoice; the karat stamp on jewellery is useful but not a substitute for a bill.

- Prices in Qatar often reflect global spot + making charges; comparing per-gram rates helps.

Packing & security

- Use small pouches for pieces, then a hard case in cabin baggage.

- Avoid loose chains that tangle (inspection gets slower).

Penalties & enforcement (what happens if you don’t declare)

If you skip declaration

- Customs may seize undeclared gold.

- You could face duty + fine and, in serious cases, arrest/prosecution under the Customs Act.

How to avoid issues

- Declare honestly, carry bills, keep weights handy, and use Red Channel.

Quick reference cards

A) Duty-free jewellery (personal use)

| Traveller | Weight cap | Value cap | Residency rule |

|---|---|---|---|

| Male | 20 g | ₹50,000 | Lived abroad >1 year |

| Female | 40 g | ₹1,00,000 | Lived abroad >1 year |

Duty-free applies to jewellery only. Bars/coins are always dutiable.

B) Duty-paid import (baggage)

| Item type | Maximum quantity | Duty today* | Declaration |

|---|---|---|---|

| Gold (incl. jewellery) | Up to 1 kg | ~6% of assessable value | Mandatory (Red Channel) |

*Airports post the official rate and calculation method; keep the receipt.

Pro Tip: If you plan repeat trips, photo-inventory your jewellery (piece, karat, grams) and staple the last customs receipt to your passport sleeve. It speeds up future checks and protects you if questions arise about pieces you wore out of India earlier.

FAQs

Can I carry gold from Qatar to India without paying any duty?

Only jewellery within the 20g/₹50,000 (men) or 40g/₹1,00,000 (women) allowance—and only if you lived abroad >1 year—is duty-free. Anything more, or any bars/coins, requires declaration and duty.

Is there a special rule for Qatar?

No. India applies the same customs rules regardless of the departure country. Buying in Qatar is fine, but Indian customs decides the allowance and duty on arrival.

What’s the maximum gold I can bring after paying duty?

Up to 1 kilogram per passenger as baggage. Over 1 kg is not permitted under passenger baggage rules.

What documents should I carry?

Invoices, ID/passport, and—if applicable—proof of >1 year residence abroad. Always keep the customs duty receipt after payment.

Related Pages

- 22K Gold Rate in Qatar Today

- 24K Gold Price in Qatar

- 21K Gold Price in Qatar

- 18K Gold Price in Qatar

- 14K Gold Price in Qatar

- 1 Tola Gold Price Today in Qatar

Sources

- CBIC — Baggage Rules, 2016 (Rule 5: Jewellery)

- CBIC Notification & Annexure — Jewellery allowances (men 20g/₹50k; women 40g/₹1L)

- Mumbai Customs — Import guidelines for gold (1 kg cap; concessional 6% duty)

- Cochin Customs — Passenger FAQs (1 kg per passenger; declaration)

- Delhi Customs — Guide to Travellers (Red/Green channel; jewellery rules)

- World Gold Council — Import duty reduced to 6% (effective 24 Jul 2024)

- NDTV — Budget 2024: Customs duty on gold cut to 6%

- Reuters — India slashes import tax on gold/silver to 6%

Checked: 21 Sep 2025